How much is Stamp Duty? The answer isn’t straightforward.

What is Stamp Duty?

Stamp duty is a tax paid when you purchase property or land.

In England and Northern Ireland, it’s known as Stamp Duty Land Tax (SDLT), in Scotland, it’s called Land and Buildings Transaction Tax (LBTT), and in Wales, it’s known as Land Transaction Tax (LTT). Each of these has its own rates and thresholds.

The amount you pay depends on the property’s price, the region where it’s located and a number of other factors: are you a first-time buyer, are you a UK resident, is this your only property, is this a non-residential or mixed-use property, are you a company, is this a new leasehold sale, etc.

For this blog, we discuss Stamp Duty on residential properties, and try to keep to the basics.

Stamp Duty rates in England

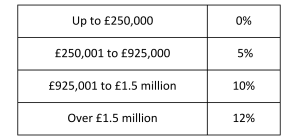

In England, the rates for residential properties are as follows:

A worked example

So, what happens if your house is £300,000?

Stamp Duty is tapered:

- For the portion up to £250,000, you pay nothing

- For the portion, £250,001 to £300,00 you pay 5%

Therefore 5% of £50,000 is £2,500.

On a £600,000 property you’d pay £17,500.

First time buyers

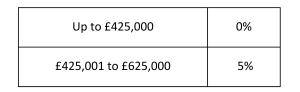

First time buyers qualify for First-Time Buyer Relief; the thresholds are higher which means, in nearly all cases, you pay less:

So on a £300,000 property, you pay nothing, if you’re a first time buyer.

On a £600,000 property you’d pay £8,750.

Properties over £625,000 do not qualify for First-Time Buyer Relief, and you would pay the standard stamp duty rates.

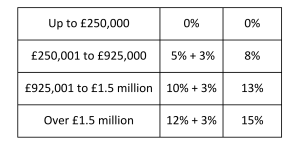

Second (or third or more) properties

If you’re buying a second home or a buy-to-let property, you will pay more – an extra 3% on the standard rates:

So, if your second property costs £300,000, you’d pay 8% of £50,000, which is £4,000.

Summary

Above we’ve listed the standard rates in England. There are plenty of factors that could change these. Rates and thresholds change, and the looming budget might introduce new elements. Always check the latest information before commencing your purchase; we’ve listed official sources below. And use a good conveyancing solicitor who can guide you through.

Conveyancing at AWB Charlesworth

3 October 2024

For more information, call into our Keighley or Skipton office or contact Declan Hayes on 01756 692888 or declan.hayes@awbclaw.co.uk